Public Mutual Epf Investment Table 2019

Epf has announced the removal of its 30 foreign fund exposure cap on members investment scheme mis commencing august 1 2016 permitting members to withdraw and invest in unit trust funds that are focused on overseas investments.

Public mutual epf investment table 2019. Who can participate in the epf members investment scheme. I should have gained rm36k more if the money were remained in kwsp. Your investment in this scheme will allow diversification of your epf savings into many possible investment portfolios.

Sadly i trusted my consultant a gud fren. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. Individuals can start investing in ppf with a minimum amount of rs.

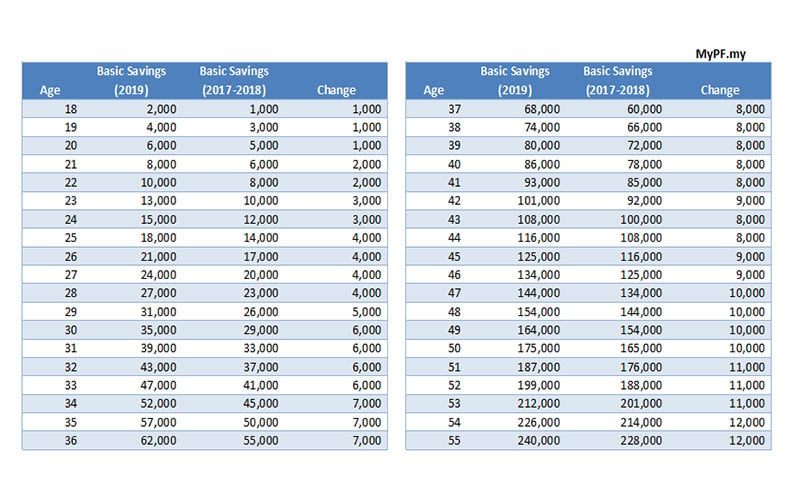

The employees provident fund epf announces that the quantum for the basic savings will be revised from the current rm228 000 to rm240 000 effective 1 january 2019. It is a long term investment scheme with a lock in period of 15 years. See part 2 here because not able to fit into 1 info graphic.

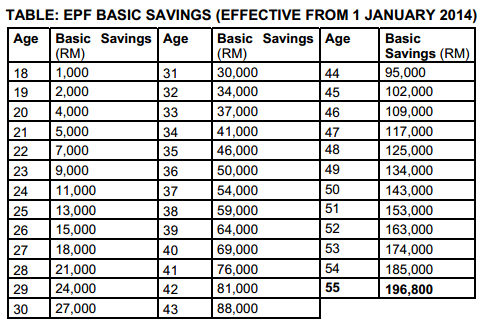

The interest rate is set and paid by the government for every quarter. The minimum amount of savings that can be withdrawn is myr 1 000 and can be made at intervals of 3 months from the last transfer subject to the availability of the basic savings requirement in account 1. The excess of basic savings in account 1 would be myr 13 000 the permitted withdrawal for member s investment will be myr 13 000 30 myr 3 900.

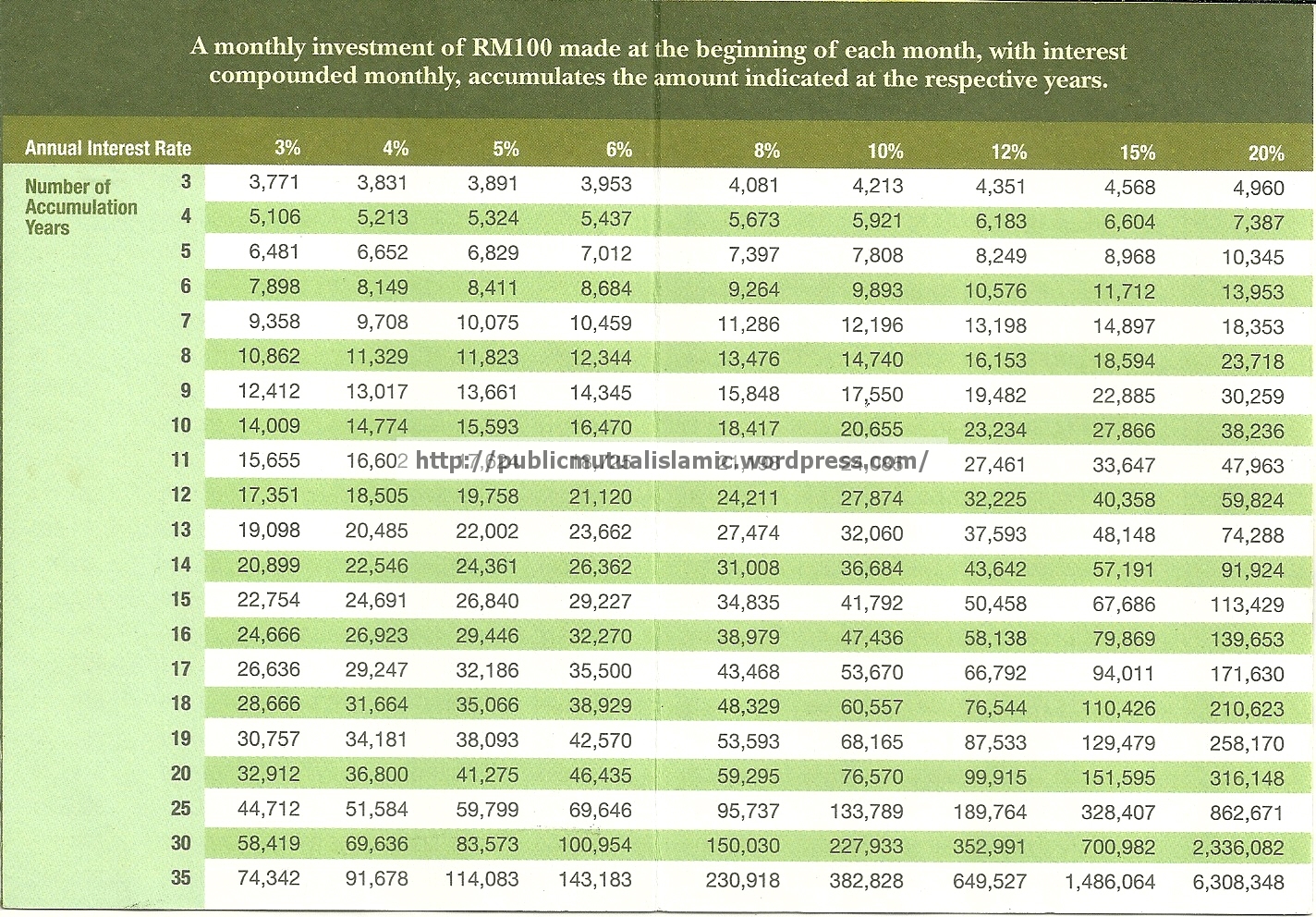

Financial freedom pocket calculator click on the picture to view lump sum investment of rm10 000 click on the picture to view monthly investment of rm100 click on the picture to view epf members investment scheme click on the picture to view. Epf helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. Public provident fund ppf is a tax free saving scheme regulated by the indian government.

Only after 10 years i did the calculation comparing the yield between kswp and unit trust. I invested in public mutual using my epf since 2010 and declined in 2019. Has myr 60 000 in his epf account.

Starting 1 january 2017 epf members are allowed to invest not more than 30 of the total amount in excess of their basic savings in account 1 through the appointed fund management institutes approved by the ministry. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia.

We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. New basic savings quantum begins january 2019. Epf withdrawal for unit trust investment.