Public Mutual Epf Fund With Insurance

See part 2 here because not able to fit into 1 info graphic.

Public mutual epf fund with insurance. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. From my milestone tab you will notice the reason why i cash out my entire public mutual fund.

Top epf performance funds from public mutual just got this information from my public mutual fund agent and i think is a good thing to share here. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services.

But the catch is no all the fund you can via if you choose to invest from epf. Epf has announced the removal of its 30 foreign fund exposure cap on members investment scheme mis commencing august 1 2016 permitting members to withdraw and invest in unit trust funds that are focused on overseas investments. Epf withdrawal for unit trust investment.

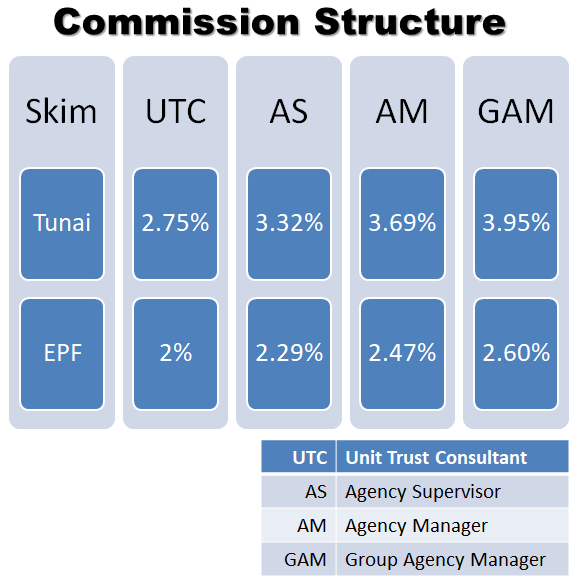

The reason is because the sales charges when one invest unit trust via epf is only 3 the sales charges for investment via cash is 5 5 6. Hence those funds bought with epf money cannot be withdrawn out its either switching or return the money back to epf. According to the irb s assessment year 2019 tax relief schedule for resident individual those in the pensionable public servant category are entitled to.

I think i forget to mentioned that i still have some funds from the money i extracted from my epf. If you plan to invest into public mutual s unit trust fund i would like to recommend you to do so via epf. This is 3 years trend for public mutual funds that allowed for epf withdrawal for investment.