My First Home Scheme Bsn

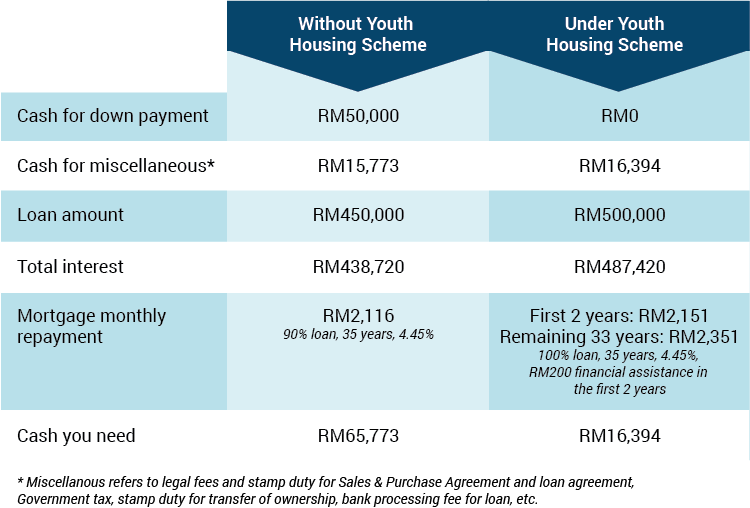

10 of the dp max 500k property.

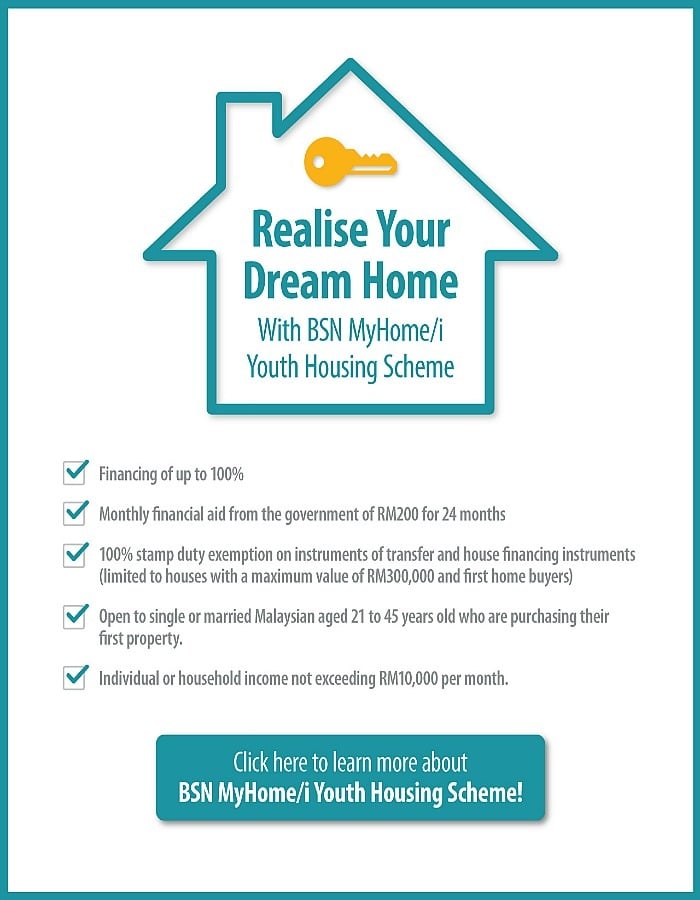

My first home scheme bsn. Bsn myhome i youth housing scheme is designed to help single or married youths own their very first home with ease. Participants must have a household income not exceeding rm10 000 per month. The scheme allows homebuyers to obtain 100 financing from financial institutions enabling them to own a home without having the need to pay a 10 down payment.

New property 500k spa price rebate 10 this 10 given by who. Bsn myhome youth housing scheme is an easy to apply home loan designed to help married youth to own their first home. Calculated on a floating rate basis bsn can provide up to 100 financing to purchase your dream house whether completed or under construction ranging between rm 100 000 and rm 500 000.

The skim rumah pertamaku or my first home scheme was first announced in the 2011 budget by the malaysian government. If 10 rebate given by developer spa price should be 450k then apply first home scheme and get another 10 from government then your property would be 450 45 405k for loan. What is the bsn myhome youth housing scheme.

Skim rumah pertamaku srp my first home scheme was first announced in the 2011 budget by the malaysian government to assist young adults who have just joined the workforce to own their first home. The housing loan is calculated on a floating rate basis with your house is offered as collateral. Which is designed to help married youth to own their first home.

First home scheme what is provided. This is one of the good initiatives taken by the government to help young adults earning rm5 000 per month or less to get 100 financing from banks to purchase their first home. Under the youth housing scheme bsn will be providing financing from rm 100 000 to rm500 000 with a tenure of 35 years or until the age of 65 whichever comes first.

Subject to bsn s due diligence you could be financed up to 100 of the. 100 of stamp duty exemption for the first rm300 000 on purchase of first property for property price up to rm500 000. Bsn myhome or bank simpanan nasional myhome is a first time homeownership scheme designed to help single or married youths own their very first home with ease by offering to finance the purchase of either completed under construction or sub sale property.

The government is also to aid monthly instalments of rm200 per month that will be credited to customer s financing account for a period of 2 years from the date of first disbursement to the developer vendor. Bsn myhome or bank simpanan nasional myhome is a homeownership scheme targeted towards first time homebuyers aiming to own their very first home. The shariah concept used is commodity murabahah tawarruq which refers to buying and selling of the commodities as the underlying asset on the deferred basis by way of murabahah sale contract with the disclosure of the asset cost price and profit margin.

Exemption period is for 2 years until december 2020. The scheme is one of the measures announced by the government in the 2011 budget aimed at assisting young adults to own a home.